Sureify

Empowering life insurers to increase the lifetime value of their policyholders by engaging them at the right time with the right information.

Context

This product consists of a B2C web and mobile product and a SaaS platform to interface various insurance companies with their customers.

My Role

I was the founding and lead designer across a team of 2 product managers, 15 engineers, and various co-founders. I led all product design and collaborated on the initial concepts of the product and business models.

The Problem

Insurance is falling behind. How can we modernize their capabilities and solve their biggest problem; engaging with their policyholders? Getting policyholders to interact with their agents, let alone their provider, is extremely difficult and agents need valuable information to better provide services.

The Goal

As we were building our company, we needed to secure funding and a customer for our pilot. So we set out to build an MVP to help us achieve this goal.

Understanding insurance & policyholders

In order to create a product that resonated with policyholders, we needed to understand what would motivate them to participate in such a program from their insurance provider. We interviewed various people who had, or were thinking about getting, a life insurance policy. We asked how they thought insurance worked (mental models), how they liked their services (pain points), and what products they used and enjoyed the most (resonation).

Our goal here was to understand our prospective users so we could create some direction before we started designing an MVP. We wanted to craft a product that empowered policyholders, but also gave vital information to insurance providers.

Business requirements

While building the system for this product, we had to understand the needs of the insurance providers as well. We focused on what’s important to them for evaluating risk and providing better services. The design of this product had to meet in the middle between the policyholders, the insurance providers, and our own company.

Insurance providers want to lower the risk of their policyholders. Being that it’s life insurance, health is paramount. The best way a provider can provide service is minimizing their risk, which means healthy policyholders. It becomes a win-win for both parties. Using technology, we can provide health and fitness services to the policyholders, and with that data, provide insurers with more information at their fingertips (and better ways to engage).

WHat makes a GOOD product… good?

We then set out to understand what made successful products so successful — primarily those in a similar space. We asked ourselves what resonated to the point that people were willing to try or adopt such a product? What characteristics were there that really made it stick?

We learned that people’s perceptions of life insurance weren’t on the best of terms, so we felt there was a level of risk involved with getting policyholders to even consider such a product from their insurance providers.

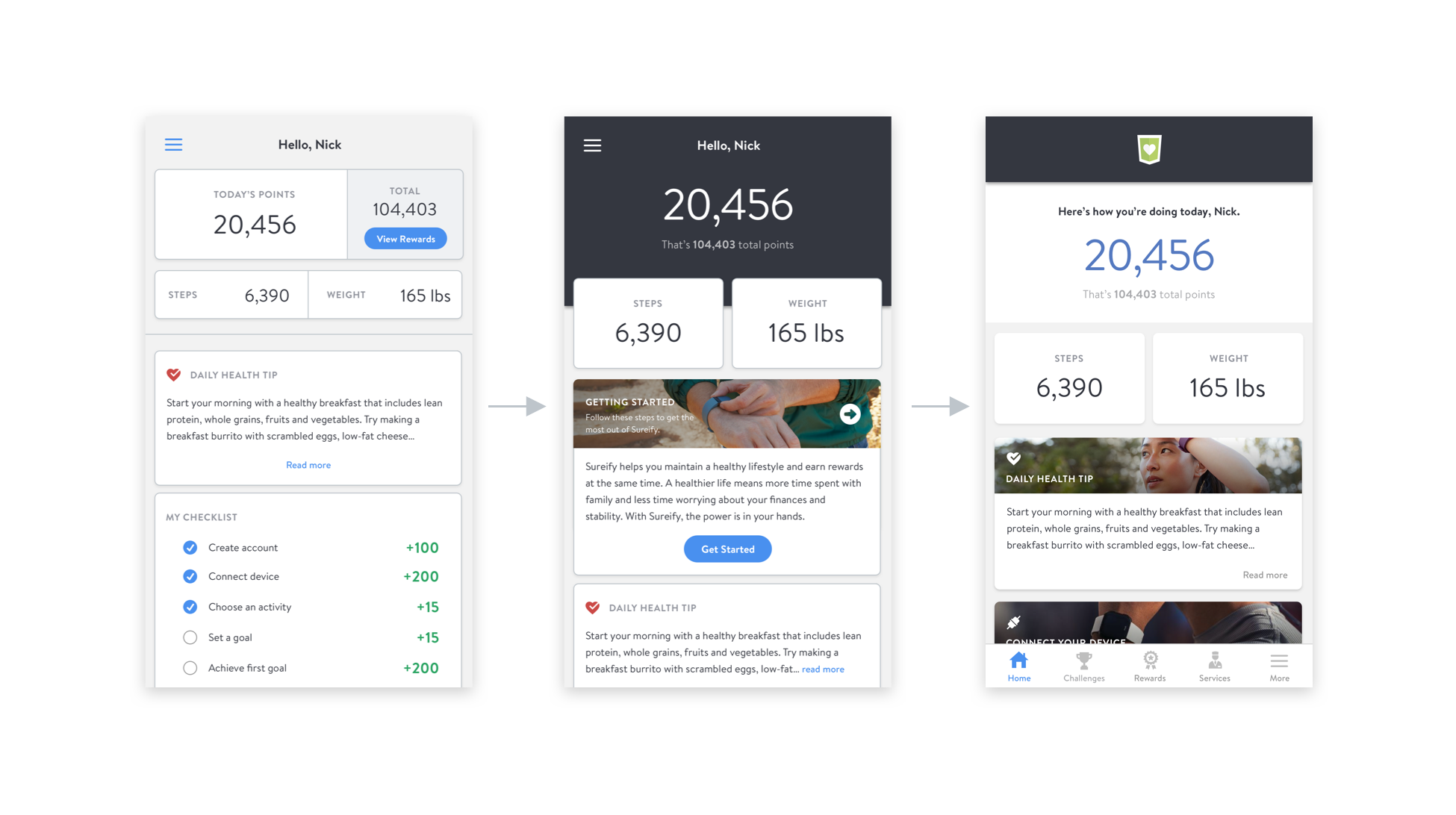

Rapid prototyping & guerrilla testing

I then designed a few rapid prototypes with the goal of getting them in front of people as soon as possible. We wanted feedback and insights. These prototypes were designed differently in both appearance and how they worked — but still met our initial business requirements. We performed guerrilla testing with people on the street, and formal interviews as well.

Iterate iterate iterate

I iterated on the prototypes based on the feedback and insights we gathered from both the people we interviewed and prospective investors. As I iterated, we explored how we could tie it with our formalized business requirements. Our initial goal was to secure a pilot with an insurance company and funding from a VC, so we had to make sure our product and business model tied together well.

Final Deliverables

I iterated on the prototypes based on the feedback and insights we gathered from both the people we interviewed and prospective investors. As I iterated, we explored how we could tie it with our formalized business requirements. Our initial goal was to secure a pilot with an insurance company and funding from a VC, so we had to make sure our product and business model were cohesive.